Allianz, a global leader in insurance and asset management, is set to launch a new life insurance product on July 26. This innovative offering promises to redefine the landscape of life insurance with its comprehensive coverage and customer-centric features. In this article, we delve into the details of Allianz’s new product, explore the importance of a robust product roadmap, and discuss effective lifecycle management strategies. We will also provide a product roadmap template, examples, and a strategic plan to ensure a successful launch. Additionally, we will highlight how lylli launchtools can aid in managing this complex process.

The New Allianz Life Insurance Product

Allianz Life Insurance Company of North America has recently launched the Allianz Life Accumulator™ Indexed Universal Life Insurance Policy. This innovative product is designed to provide powerful accumulation potential and unique “index lock” features. The index lock allows policyholders to lock in an index value at any point, even when the market hits 0. This feature provides a level of security and peace of mind, knowing that your money is protected from market downturns1.

The Allianz Life Accumulator™ offers flexible loan provisions and new index choices, making it a versatile option for meeting your financial needs now and into retirement. With this policy, you can build your accumulation value through earned interest without the risk of loss due to market volatility. The policy also provides a death benefit that is generally income-tax-free for beneficiaries, helping your family maintain their way of life when you pass away1.

In addition to these features, the Allianz Life Accumulator™ allows you to access any available cash value via policy loans and withdrawals. This flexibility means you can use the funds for various needs, such as supplementing retirement income, paying for college, or covering unexpected expenses. The policy is designed to be customizable, offering different options for building your accumulation value and tailoring the coverage to your specific needs1.

Overall, the Allianz Life Accumulator™ is a comprehensive and innovative solution for those looking to secure their financial future. Whether you’re planning for retirement or looking to provide for your loved ones, this policy offers the tools and flexibility to help you achieve your financial goals1.

Allianz’s new life insurance product is designed to offer comprehensive coverage, flexibility, and exceptional customer service. The product aims to meet the diverse needs of policyholders, providing financial security and peace of mind. Key features include:

- Comprehensive Coverage: The new product offers extensive coverage options, ensuring policyholders are protected in various life scenarios.

- Flexibility: Policyholders can customize their plans to suit their unique needs and financial goals.

- Affordable Premiums: Competitive pricing makes high-quality life insurance accessible to a broader audience.

- Enhanced Customer Service: Allianz’s renowned customer service ensures that policyholders receive the support and guidance they need throughout their policy term.

Customer Testimonials

Paul Williams, New York, NY

“Allianz’s new life insurance product is exactly what I was looking for. The comprehensive coverage and flexible options allowed me to tailor my plan to fit my family’s needs perfectly. The affordable premiums were an added bonus!”

Maria Rodrigues, Los Angeles, CA

“I’ve been an Allianz customer for years, and this new product exceeded my expectations. The enhanced customer service is outstanding, and I feel confident knowing that my family is well-protected.”

David Fuller, Chicago, IL

“The launch of Allianz’s new life insurance product came at the perfect time for me. The customization options and competitive pricing made it an easy decision. I highly recommend it to anyone looking for reliable life insurance.”

The Importance of a Robust Product Roadmap

A product roadmap is a strategic document that outlines the vision, direction, priorities, and progress of a product over time. It serves as a blueprint for product development and helps align the efforts of various teams. For Allianz’s new life insurance product, a well-structured roadmap is essential to ensure a smooth launch and sustained success.

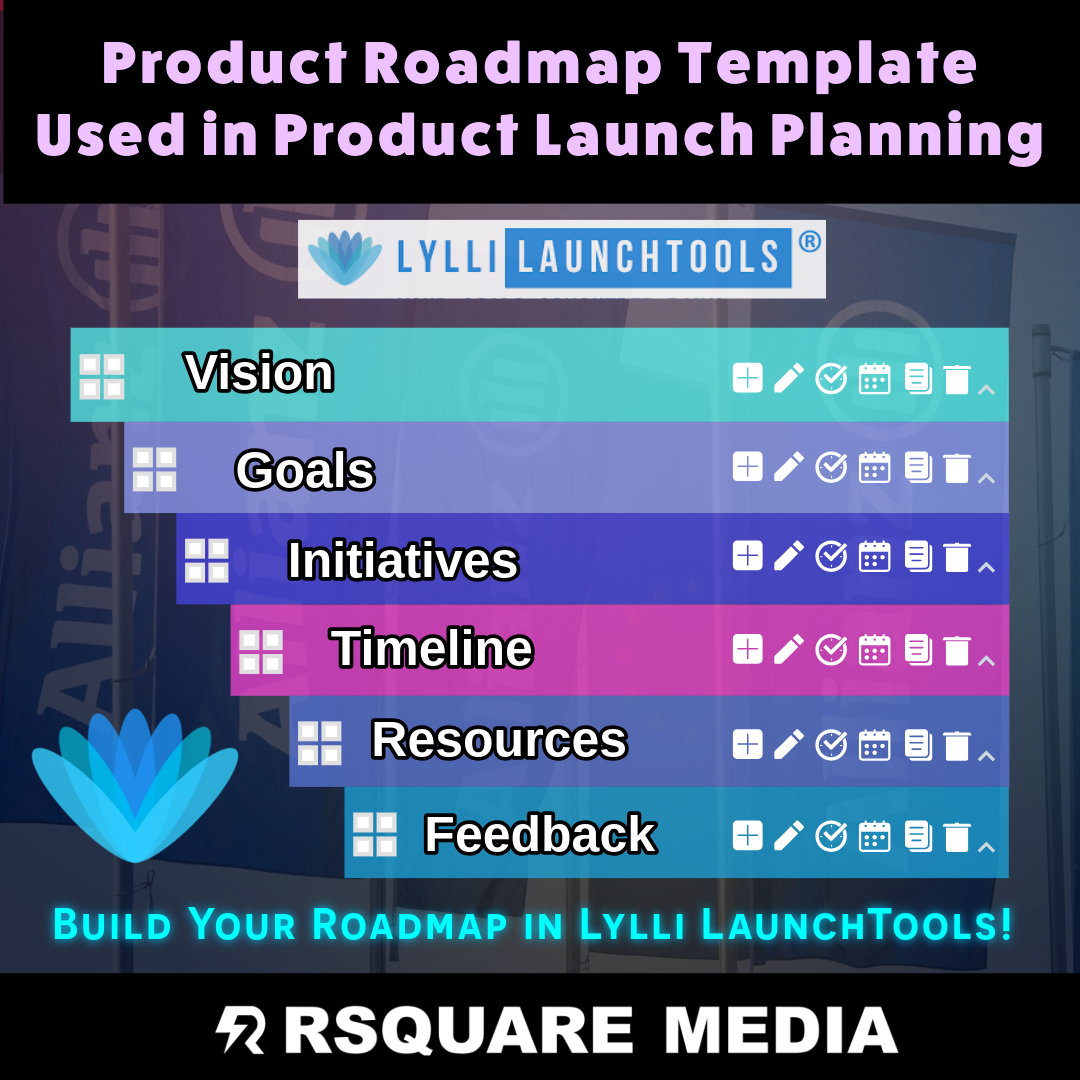

Key Components of a Product Roadmap

- Vision: Define the long-term vision and goals for the product.

- Goals: Set specific, measurable goals to track progress and success.

- Initiatives: Identify key initiatives and projects that will drive the product towards its goals.

- Timeline: Establish a timeline with milestones and deadlines for each phase of development.

- Resources: Allocate resources and assign responsibilities to team members.

- Feedback: Create mechanisms for collecting and incorporating feedback from stakeholders and customers.

Crafting a Product Roadmap: Template and Example

Product Roadmap Template

- Vision: Outline the overarching vision for the product.

- Goals: Specify clear, measurable goals for the product.

- Initiatives: List the key initiatives that will help achieve the goals.

- Timeline: Develop a timeline with critical milestones and deadlines.

- Resources: Detail the resources required and assign responsibilities.

- Feedback: Implement a system for gathering and integrating feedback.

Product Roadmap Example

Vision: To provide the most comprehensive and flexible life insurance product in the market.

Goals:

- Achieve a 95% customer satisfaction rate within the first year.

- Increase market share by 15% in the first two years.

- Launch additional customizable options based on customer feedback.

Initiatives:

- Develop and test the product’s core features.

- Create marketing and awareness campaigns.

- Train customer service teams to handle new product inquiries and support.

- Establish partnerships with financial advisors and brokers.

Timeline:

- January-March: Product development and initial testing.

- April-June: Marketing campaign creation and customer service training.

- July: Product launch and initial feedback collection.

- August-December: Continuous improvement based on customer feedback and market analysis.

Resources:

- Product Development Team: Responsible for creating and testing the product.

- Marketing Team: Develops and executes the marketing strategy.

- Customer Service Team: Provides support and handles inquiries.

- Financial Advisors/Brokers: Facilitate product sales and provide customer guidance.

Feedback:

- Surveys: Collect feedback from policyholders through surveys.

- Focus Groups: Conduct focus groups to gather in-depth insights.

- Customer Reviews: Monitor customer reviews and adjust the product accordingly.

Strategic Planning for Product Launch

Strategic planning is crucial for the successful launch of Allianz’s new life insurance product. It involves setting clear objectives, identifying target markets, and developing a comprehensive marketing strategy.

Key Elements of Strategic Planning

- Market Analysis: Conduct a thorough market analysis to understand customer needs and preferences.

- Target Audience: Identify the primary and secondary target audiences for the product.

- Marketing Strategy: Develop a multi-channel marketing strategy that includes digital marketing, social media campaigns, influencer partnerships, and traditional media.

- Sales Strategy: Create a sales strategy that outlines pricing, distribution channels, and promotional offers.

- Evaluation: Establish metrics for evaluating the success of the product launch and make adjustments as needed.

Strategic Plan Example

- Market Analysis: Conduct a detailed analysis of the life insurance market, focusing on customer demographics, preferences, and competitive landscape.

- Target Audience: Identify the target audience, including young professionals, families, and retirees looking for comprehensive life insurance coverage.

- Marketing Strategy: Develop a marketing strategy that includes:

- Digital Marketing: Utilize SEO, PPC, and social media advertising to reach the target audience.

- Social Media Campaigns: Engage with potential customers on platforms like Facebook, Instagram, and LinkedIn.

- Influencer Partnerships: Collaborate with influencers in the finance and insurance sectors to promote the product.

- Traditional Media: Use print, radio, and TV ads to reach a broader audience.

- Sales Strategy: Outline a sales strategy that includes:

- Pricing: Offer competitive pricing with various premium options.

- Distribution Channels: Sell the product through Allianz’s website, financial advisors, brokers, and partner agencies.

- Promotional Offers: Provide introductory discounts and special offers for new customers.

- Evaluation: Establish key performance indicators (KPIs) such as customer satisfaction rates, market share growth, and sales figures to evaluate the product launch’s success.

Managing the Product Lifecycle with lylli launchtools

Effective product lifecycle management is crucial for maintaining the success of Allianz’s new life insurance product. lylli launchtools is a project management software that can help streamline this process by providing tools for planning, execution, and monitoring.

Key Features of lylli launchtools

- Product Roadmap Management: Create and manage detailed product roadmaps that outline the stages of product development and launch.

- Product Lifecycle Management: Monitor and manage every stage of the product lifecycle, ensuring deadlines are met and quality is maintained.

- Collaboration Tools: Facilitate seamless collaboration between team members, allowing for efficient communication and project tracking.

- Data Analytics: Gain insights into product performance with comprehensive data analytics and reporting tools.

Creating a Strategic Plan with lylli launchtools

lylli launchtools can assist in creating and executing a strategic plan for Allianz’s new life insurance product launch. Here’s how:

- Product Roadmap Creation: Use lylli launchtools to create a detailed product roadmap, outlining the vision, goals, initiatives, timeline, and resources.

- Task Management: Assign tasks to team members and track progress using lylli launchtools’ task management features.

- Collaboration: Utilize collaboration tools to ensure seamless communication and coordination among team members.

- Performance Monitoring: Use data analytics to monitor the product’s performance and make data-driven decisions for continuous improvement.

Call to Action: Schedule a Free Consultation with Rsquare Media

Are you looking to streamline your product lifecycle management and create a winning product roadmap? Rsquare Media offers expert consultation services to help you achieve your business goals. Schedule a free consultation with our team today and take the first step towards a successful product launch.

Call to Action:

Click here to schedule your free consultation with Rsquare Media and discover how we can help you manage your product lifecycle, develop a strategic plan, and create a product roadmap that ensures success.

Conclusion

Allianz’s new life insurance product is poised to make a significant impact in the insurance market with its comprehensive coverage, flexibility, and exceptional customer service. As you prepare for the product launch, remember the importance of a well-structured product roadmap and strategic planning. With the help of lylli launchtools and expert consultation from Rsquare Media, you can effectively manage your product lifecycle and achieve your business objectives. Don’t miss out on the opportunity to elevate your product launch strategy—schedule your free consultation today.